What Dentistry Teaches Us About Broken Incentives

By Dr. David Phelps

“Doc, can you just drill it out and fill it?”

That’s the script. Everyone knows the lines.

Patch. Pay. Move on.

Six months later—same tooth. Same problem. Worse decay. Infection. This time it reaches the nerve. Now a root canal. Maybe a crown—if the patient can swallow the cost. Maybe not. Maybe just a bigger filling, a fragile bandage over a festering wound.

Eventually, the tooth cracks. It can’t be saved.

Extraction.

It’s a dance we all know too well. Patch it up, keep it cheap, and move on.

In dentistry, we see it every day. The downstream effects of short-term thinking. Never mind that a more comprehensive treatment plan might provide better long-term results. Never mind that the tooth could use a full-coverage restoration. That costs more. It requires sacrifice. So, what do we do?

We do what the incentives tell us to do. Drill it, patch it, send the patient on their way.

And six months later? They're back. Same habits: sipping soda, chewing sugar. Recurrent decay. More damage.

Whose fault is it? Ours? The system?

The incentives drive the behavior. The insurance model rewards transactions, not prevention. So, we do it again. Drill. Fill. We hit the nerve. Now we get to do a root canal. Maybe a crown? Too expensive. So we slap a larger filling on top and cross our fingers.

This is a perfect snapshot of the extraction economy, and it doesn’t just live in the dental operatory. It lives on Wall Street. It lives in real estate. It lives in private equity. It’s systemic.

The Illusion of Value

Dentistry is not alone.

Wall Street plays the same game. Real estate, too. Private equity, politics, even education. It’s everywhere.

The same incentives that pull a dentist’s hand toward the drill pull a trader’s finger to the “sell” button. Quick. Shallow. Extractive.

Just like in dentistry, the economy has been shaped by incentives that reward short-term transactions over long-term value.

The extraction model says: “Don’t build. Don’t create. Just aggregate, take the profit, and move on.”

Private equity has applied this model to our profession. They’re not building anything—they’re extracting value from the people who do.

It’s not just PE. The entire financial world has run on arbitrage for the past 15 years—cheap money, quick flips, short-term gains. The trader mindset has infected everything.

The Trader vs. The Investor

Let’s make a distinction: Traders chase the next win. Investors build for the long haul.

Traders speculate. They play the sentiment, the narrative, the hype. They’re in and out, often leaving others to deal with the consequences.

Investors produce. They focus on fundamentals, durability, real value creation. They understand that lasting wealth takes time, patience, and sometimes sacrifice.

In our practices, we see this play out. When we build a culture of education, prevention, and long-term care, we act like investors. But when we cave to the transaction—drill, fill, bill—we slip into trader mode.

Reconstructing After Collapse

Eventually, too many extractions lead to collapse. The occlusion gives out. The vertical stops are gone. The entire bite is compromised.

Now what? Now it’s time for reconstruction. Now it’s time for bone grafts, implants, and full-arch solutions—what we should have done earlier, but didn’t.

This same pattern is unfolding in the larger economy. Years of speculation and extraction are showing cracks.

Investment models that thrived on leverage are buckling under higher interest rates. Markets propped up by artificial liquidity are struggling to stand on their own.

The extraction model works until it doesn’t. Then comes the reckoning.

The New Era Demands Fundamentals

What we need now—whether in business or investing—is a return to fundamentals.

Durability. Cash flow. Real value.

That means focusing less on the big exit and more on long-term sustainability. It means putting less trust in financial engineers and more in the producers—the entrepreneurs, the operators, the value creators.

The old game was about speed. The new game is about staying power.

D4s and DSOs: A Cautionary Tale

Even the newest generation is being sold the trader's dream. I see it all the time—D4s being told they can graduate, roll up practices, flip them, and make a fortune.

[Related Article: Why the Big Exit Is a Bad Bet in Today’s Economy]

That’s yesterday’s model. It was built on leverage, cheap capital, and inflated multiples. That ship is sailing. And if you try to chase it now, you may find yourself holding the bag.

Private equity can make it look shiny on the surface, but many DSOs add no real value. They load good practices with debt, cut the team, trim the services, and try to ride it until it collapses.

Efficiencies are great. I support those. But cutting out the heart of a practice—its people and its purpose—is not efficient. It’s destructive.

What We Must Do Differently

So where do we go from here? We shift from extraction to creation. From speculation to sustainability. From hype to health.

- Create value, don’t extract it

Whether in your business, investments, or life—ask what you’re building that lasts. - Educate your patients—and yourself

Value isn’t obvious to most people. It must be taught. That applies in clinical care and in your financial life. - Play the long game

Short-term wins feel good—but long-term durability wins. Focus on strategies that will work in five, ten, or twenty years. - Be skeptical of narratives

Just because everyone’s doing it doesn’t mean it’s wise. If it sounds too good to be true, it probably is. - Invest in fundamentals

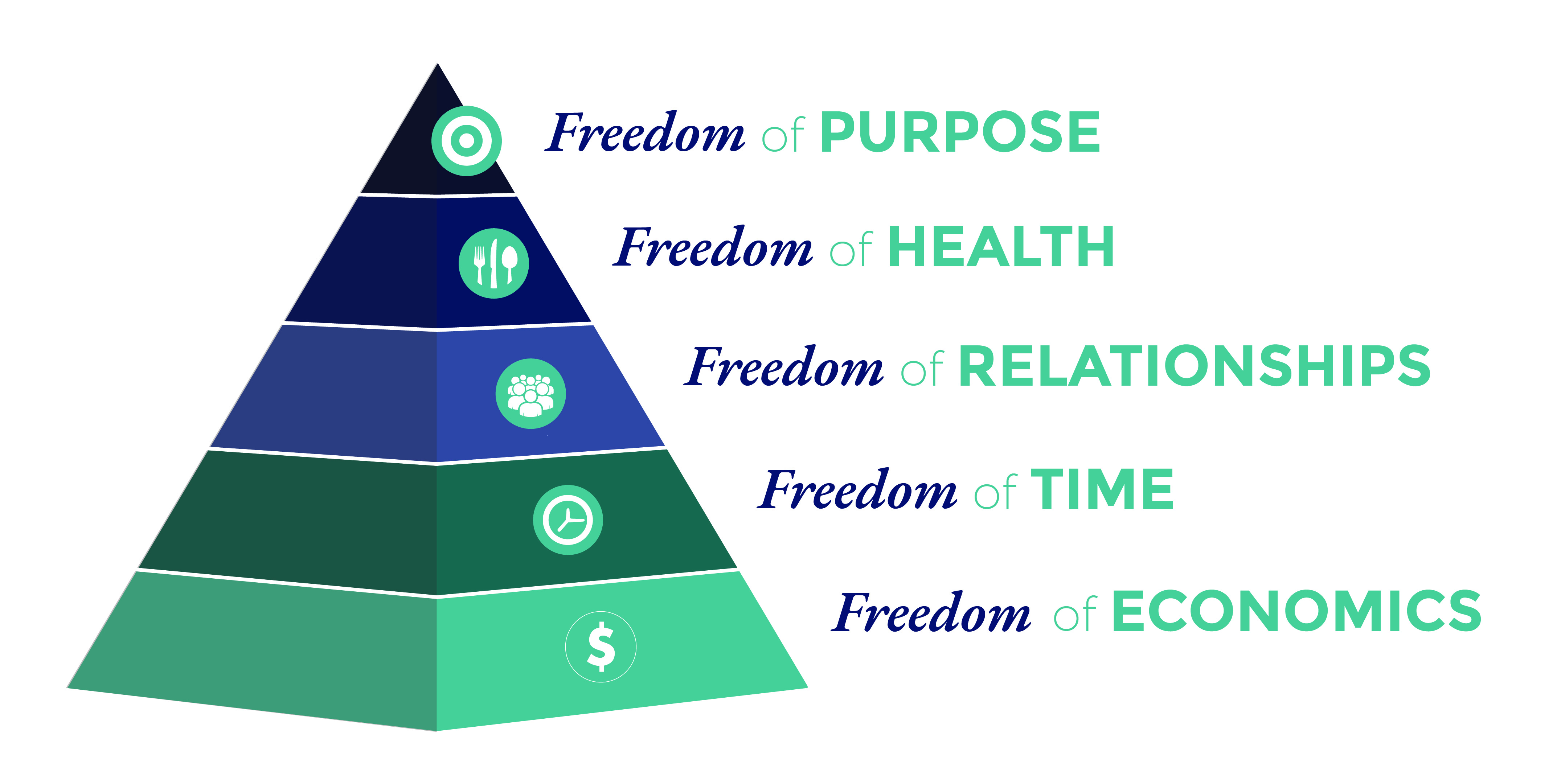

People, relationships, leadership, communication, real assets. These are the foundations of wealth that endure.

Final Thought: Produce, Don’t Just Consume

If I could leave you with one message, it’s this: Produce something of value. Be an investor and not a trader.

In your practice. In your investments. In your life.

Extraction is short-lived. Production is legacy.

It won’t always be easy. It won’t always be fast. But in this new economy, it will be necessary.

Let’s build what lasts.