by Dr David Phelps

I am often asked, “David, what should I do about my investments right now?”

(Note: I am not a financial advisor, but I can give some basic guidelines for you to learn what investing for practice professionals can look like.)

It's important to understand where we are in the cycle of the markets.

Over the last 40 years, we have seen a really long secular cycle – going back to 1980 – the lowering of interest rates down to almost zero in July, 2021. This was a 7,000 year historical low.

But the tide is turning on a major long trend cycle. What does that mean for us?

The Times are Changing

We are in a new secular cycle in the market. There are many reasons for this, but two main causes were the subsidized artificial interest rates – thanks to the Federal Reserve’s monetary policy that flooded our country and our citizens with fiat currency – and the huge (now monstrous) sovereign government debt. It’s over 31 and a half trillion unfunded liabilities and over a hundred trillion dollars. It never ends.

So when I say, “This time is different” I am referencing the idea of the Federal Reserve kicking the can down the road, the optimism about continued growth, and the possibility of being able to “buy the dip” as the stock market rebounds. I say, HOLD YOUR HORSES.

Nobody knows exactly what's going to happen BUT I would hedge my bets on having more of what we saw in the seventies – stagflation. Stagflation is high inflation and an anemic economy.

This is an entirely new environment that requires new strategies.

Inflation right now is definitely on our minds right now, particularly consumer price inflation. The CPI seems to be coming down a little bit, but it’s still at 6.4% based on last month's CPI report. You have to at least double that number they give because they manipulate the number to look “prettier” than it is. The actual consumer price inflation is probably running around 12 or 13% at a minimum.

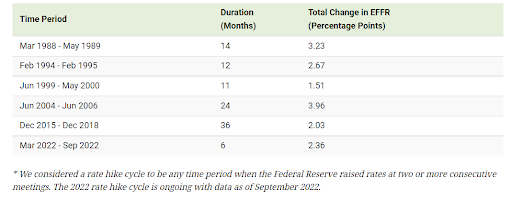

Add that to the fact that over the last 12 months we have experienced the fastest interest rate rise by the Federal Reserve in history. We've gone from just about zero basis to almost 5% very quickly. That's a massive rise. You can't have that big of an increase in interest rates with the debt that this country has and say all the good things of the previous years are going to continue.

Something will break. I can't tell you when. But I can tell you that the time is now to prepare and hedge against it.

Visual Capitalist and World Economic Forum

How Do You Hedge Against Stagflation?

Ask yourself, What's the greatest downside risk you have?

Today that is expecting continued growth. To assume that the stock market, real estate and business multiples will always continue to grow at the rate we’ve seen in the most recent decade is an assumption that is based on faulty linear extrapolation.

The cheap money that fueled this growth for so many years is running out.

The unprecedented amounts of money (trillions) that the Federal Reserve and Congress pumped into the economy during Covid particularly, even going back to the 2008 great financial crisis; has devalued the currency. This means that the worth of a dollar has decreased and prices in general have gone up.

Now we are in a deflationary period with higher interest rates, higher cost of capital and a decrease in liquidity. The credit markets or the financial markets will eventually tighten, if not seize up completely.

We've seen this in past cycles, the continued downfall of equity evaluations across the board.

I don't care if you're talking about the stock market, real estate, or your own business/dental practice. They will all see a decrease.

So the first thing to do is recognize that the same opportunities that were available before will not get us the results that we want. One cannot simply index to the market and assume that you will experience growth.

Now, what can we do about it today in our investments and businesses?

We have to look back to the fundamentals for investing for practice professionals

Seek merit-based investing or merit-based business models. For example, we have to look at operational efficiencies (if there is any and how effective) in our investment or business models.

Investments will have to stand on their own merit.

We haven't had to do that for a long time. Why? Because there's always been a greater fool who would buy whatever you held – a business, an investment – at a higher price. Remember, money was cheap and this was an option.

That has now stopped. If you stay invested in and build a business for the quick exit, the high profits, it’s worked in the past, but it will NOT work now. The lag effect of what's happened in the last year is only starting to catch up to us now. I totally expect to see a greater devaluation of equity assets (deflation), and most likely a recession or depression. That's where we are headed. But that’s also where the opportunities arise.

Now is the time to hedge. It is time to preserve capital so that you have the dry powder necessary to acquire assets on sale. I will be keeping my money in higher liquidity elements today. Safe and liquid investments.

Maybe I won’t get the same returns I was getting 3-5 years ago, but I know I can make more on the other side of this downturn/recession. You can do that when you become a sophisticated investor and know when it’s the right time.

How Do You Become a Sophisticated Investor?

Do you need to go to school and get an MBA or other degrees in finance, real estate or something else?

I have never done that. There's a faster way – by being connected to groups of people that have already gone down that path and are bringing, discussing, and vetting the opportunities as a group. This is having what I call “access points” to those opportunities as they come up.

You won't get that on Wall Street. You won't get that in the major markets where retail investors don’t have a place to play. That's the key to your financial future success – finding your access points.

Becoming a more sophisticated investor has never been more prudent for you to do – For your own longevity, for your own legacy, for what you will teach your children.

The whole marketplace has been distorted. The incentives have been perverted for too many years. It will be very, very tough for some people.

But those who are positioned well, will do very well. You can trust me on that.

To your freedom!

– David

P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with My Team:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then schedule a call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to attend one of our upcoming member events as a guest. www.freedomfounders.com/schedule

2. Become a Full-Cycle Investor:

There are many self-proclaimed genius investors today who think everything they touch turns to gold. But they’re about to learn the hard way what others have gained through “expensive” experience. I’m offering a free report on how to become a full-cycle investor, who knows how to preserve and grow capital in Up and Down markets. Will you be prepared when the inevitable recession hits? Get your free report here.

3. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Click here to take the 3 minute assessment and get your scorecard.