Counterparty Risk – How to Avoid Being Drowned in the Whirlpool of a Sinking Economy

When it comes to financial planning for dentists, doctors and more, I believe we are seeing the initial signs of a significant unraveling of the boom economy.

- Consumer prices per the BLS rose 0.4% in September and were up 8.2% from 2021.

- S&P finishes another quarter of significant losses.

- JP Morgan stockpiles $428M to hedge against potential losses.

- The Fed is poised to continue aggressive interest rate hikes.

- 20% of companies on the Russell 3,000 index are losing money (Zombie companies)

- The Auto loan bubble is now beginning to pop.

- Housing is experiencing significant “cooling” in certain markets

The September CPI was up 8.2% since last year (if you believe the government issued stats. Try doubling that figure to 16% – probably closer to what the consumer is experiencing right now).

At 9%, the retirement nest egg that is supposed to last 25-30 years is cut in half every 8 years. Do the math. $2M becomes $1M becomes $500K in only 16 years. How’s that supposed to work out while your Wall Street returns are on the downslope?

These numbers will force a heavy-handed response from the Fed.

Post-CPI futures are pointing to a growing likelihood of a full-point Fed rate hike. Do you want to be on the market roller coaster when that headline hits? It’s amazing to me that the markets wouldn’t have anticipated the inflation rate to be higher. Everyone was secretly hoping against hope for the “soft landing” the Fed has been promising.

That is wishful thinking.

Insights on Financial Planning for Dentists – Consumer Inflation meets Asset Deflation

While the rank and file are experiencing massive inflation on the day-to-day purchases (gas, utilities, the supermarket) we are simultaneously seeing the beginning of asset deflation.

Financial market equities, bonds, commodities, cryptocurrency and real estate – across the board. This is a nasty one-two punch. Your dollars can buy less and less while financial assets (401ks, brokerages, etc) are being decimated.

Decades of artificially low interest rates have caused over leveraging in almost all asset classes.

They’re like households who sustain lifestyles on credit cards or lines of credit. Yes, you can roll debt over and over for a time, but eventually you’ll find yourself living in a house of cards. This has been happening on a grand scale in the capital markets – with very, very big numbers.

As the Fed raises rates to fight inflation, capital markets will dry up and debt will become much more expensive. The over leveraged players on Wall Street and in the capital markets will begin to experience compression.

Don’t be tempted to think this won’t affect you.

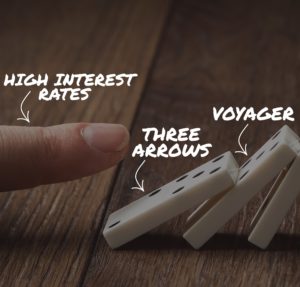

There is a lagging domino effect due to large amounts of counterparty risk. Meaning, things are so tied together that if one sector falters, it sends shockwaves through the entire system. Just because you’re not directly invested in a specific asset class or with a specific financial player doesn’t mean you are insulated from their distress.

Today’s highly leveraged environment spreads the risk. Investors need to stay alert – regardless of whether or not you have direct exposure to Crypto or other markets facing volatility at the moment.

We’re all going to be affected to various degrees, depending upon how prepared and proactive we are in the repositioning of business models and investments.

When it comes to counterparty risk and financial planning for dentists, how do you avoid being drowned in the wreckage?

Counterparty risk is risk exposure to the failure/default of other parties. It’s what famously brought Lehman Brothers down in 2008, Long-Term Capital Management back in the 90s, and of course, more recently – Voyager (see above).

Today, I see growing counterparty risk in real estate as well as Wall Street. New operators, syndicators and sponsors entering the markets late in the game.

They have based their investment models on the historically low interest rates we’ve seen over the last few decades. It’s easy for these operators to sell their offerings with appealing IRRs and projected returns, but the math behind those projections is based on past trends – not the realities we will be experiencing moving forward.

As the interest rate environment changes (and it is changing) many operators will find themselves over-leveraged and unable to stay above water.

The result will have a domino effect on real estate equities. For those who are properly positioned, this creates opportunities – as long as you are not tied to the sinking wreckage.

A recent Freedom Founders member admitted that he had been “lucky” with his investments over the last few years. The rising tide lifts all boats. But as markets shift – luck for many will run out. Those with discernment and time-tested guard rails will prevail.

Unless you become a John Wayne rugged individualist on an off-grid farm, you will have exposure to counterparty risk in your life.

How can you structure investments to reduce the risk of being sucked down and drowned in the wreckage caused by the failure/default of major market players in a significant correction?

Keys to mitigating CounterParty Risk:

- Securing wealth with real, tangible assets that have fundamental utility/value.

- Strategic approach to leverage – mitigating exposure to short term lines of credit/adjustable rates.

- Investing primarily for cash flow vs equity speculation.

- Due Diligence – first at the relational level (values, character), asset level second.

- One degree of separation from key decision makers (not possible on Wall Street).

- Developing skill sets in stress testing, deal structuring and exit strategies.

- Access to an early warning system of relevant shifts/trends (signal vs noise).

- The leverage of a tribe/community to create accountability and guidance.

Those are the risk mitigation strategies I have endeavored to build into the foundation of the Freedom Founders community. The best collaborations are set up to reduce counterparty risk and mitigate economic contagion. They create economic plasticity – meaning, the ability for individual players to adapt to a changing environment.

Static financial planning for dentists and others will not survive in a dynamic world.

Having a board of advisors who have access to an early warning system of relevant shifts gives each of us the ability to adapt to an ever-changing environment. It also gives us access to take advantage of the once in a lifetime opportunities that are created when markets clean house.

Great wealth is made during times like this IF you know how.

I have successfully multiplied my net worth over 40 years. No home runs – only knowing how to use my network and the market cycles to my advantage. I’ve also carefully mitigated exposure to systemic risks. Let the markets do as they will – the less impact they have on me and my wealth – the better.

Great wealth is made during times like this IF you know how.

To your freedom!

– David

P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with My Team:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then schedule a call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to attend one of our upcoming member events as a guest. www.freedomfounders.com/schedule

2. Become a Full-Cycle Investor:

There are many self-proclaimed genius investors today who think everything they touch turns to gold. But they’re about to learn the hard way what others have gained through “expensive” experience. I’m offering a free report on how to become a full-cycle investor, who knows how to preserve and grow capital in Up and Down markets. Will you be prepared when the inevitable recession hits? Get your free report here.

3. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Click here to take the 3 minute assessment and get your scorecard.