by Dr David Phelps

Many people ask me, “David, where are you investing today?”

With the market rolling over, we are heading for a course correction. The higher cost of capital is changing market dynamics, ultimately leading to a recession, potentially a deep one.

Before I explain how my investment strategies have changed, I’ll explain why they needed to change.

A Correction Always Comes Around

I started investing when I was 22, back in 1980. That's over 40 years of investing throughout various market cycles, primarily in alternative investments.

I also owned a professional practice, which I managed and operated for a number of years through various cycles.

Over my years of experience, I’ve learned how market cycles behave and work. I don't have a perfect timing of when changes will occur, but I do know what happens when change does occur in a market cycle. I believe we are currently experiencing the turning of a market cycle right now.

The pundits talk about a soft landing. “This is the bottom, and now we will turn the corner. Things are going to go back. We'll see interest rates go down, and all will be good.”

People can have their own opinions, but I take a counterpoint when there's a saturation of opinion on one side. There is definitely a saturated opinion that everything will be okay and that the worst is behind us.

I tend to look the other way when so many focus on one direction. In life, I've found that even though I could be wrong, I'd rather be on the conservative side.

I do the same with my investment capital, even if I am wrong and miss some of the highs that may still come in the marketplace. The Federal Reserve and Congress have a habit of kicking the can down the road repeatedly, but they're running out of steam.

When we have the correction, which I think we will roll into before the end of this year, it will be relatively dramatic. Will it be as dramatic as 2008? No one can predict exactly how much, but there is potential it could be.

If it is anything like 2008, losing equity or principle in your various investments can set you back years, maybe a decade or more. Back in the dot com crash, the NASDAQ took 15 years to recover.

Higher Returns Do Not Always Translate to Income

It has been wonderful to receive great returns in financial products, alternatives, crypto, and almost any asset for the last few years. But unless you know how to take chips off the table at the right time, move to higher ground, and turn that capital into income, those returns won’t translate to sustainable success.

We all need income, replacement income once you leave active work, not just net worth. Your Freedom should be sustained by more than siphoning from a pile of money you saved up (The Traditional Accumulation Model).

We need income that is not dependent on us actively trading our time or that is dependent on the behavior of the current markets. We need sustainable and predictable income throughout all market cycles.

But to create that income, we must first invest our capital. Let me explain where I am investing today.

Move Your Investment Capital to Higher Ground

I have moved my investment capital to higher ground, which for me is in cash or near cash equivalents.

Near cash equivalents can be short-term treasury bills, essentially risk-free at about five and a half percent today. We haven't seen that rate of return on risk-free treasury bills in 16 years.

However, inflation is probably running at least at that rate today. So, when investing in short-term treasury bills, you may be just breaking even. So what’s another option?

When there is an upmarket/bull market, we want to be on the equity side. We want to have ownership. That is how we get the tax benefits and the inflation hedge.

Equity investing creates profit by adding value to the asset (value-add) in some form and then selling it for more than you purchased it for. This model has worked well for most in the past few years, but right now, that equity is at risk.

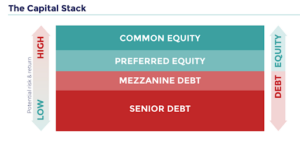

We are entering an era in which equity is being squeezed. The value of said equity will drop to some degree over the next quarters and into the next year or two. That’s why I'd rather be on the debt side, lending money or acting like a bank.

But how do you lend money? And who do you lend money to? This is another reason why real estate is my favorite alternative asset class.

I have learned how to lend money to operators who need capital to keep their operations going, particularly as interest rates have been climbing.

Credit markets, banks, and lending institutions are cutting back on the amount of loans they make today because of capital costs and the lack of liquidity in the marketplace.

This leaves opportunity in the marketplace and makes now a perfect time to be a private lender.

The Benefits of Private Lending

As a private lender, you receive what’s termed “first money out”. This means you get paid first before equity investors.

When you borrow money from the bank to buy something – a house, commercial property, etc. – the bank always gets paid first. Whatever the interest rate is, they get paid first, and then you, the owner, get paid second.

I prefer to be the first money out, especially during a market correction. And the beauty of alternative investments, particularly real estate, is that it is an inefficient marketplace.

In the secondary market, people like us, as retail investors, have the opportunity to lend our money to vetted borrowers with real estate backing. We, of course, still need to do our due diligence, but it is a huge opportunity today.

Most people don't understand the debt side of the real estate capital stack and have no experience investing in it. They only know how to invest in equities.

Find a Community of Experienced Investors

If you have no experience investing in debt, find a place or community where you can learn how to do so. Learning how to reposition your capital during market cycles, particularly during a recession or correction, is crucial to mitigate the loss of principal and continue creating that sustainable and predictable income that we all desire.

Beware of over-exposure to equities at this stage of the market cycle. Failure to make a move and take chips off the table at the right time, can result in more than a decade of lost time. Do you really want to risk that?

This is what we do at Freedom Founders. It is the connections, access points, wisdom, and collective brain trust that we have formed over the last 13 years.

This is a time when you need to understand how to position yourself for the future, not just right now, during this correction.

Becoming your best financial advocate is the only way to be most prepared now, a decade from now, two decades from now, and beyond.

These are skill sets you can take to the bank for the rest of your life and pass on to your kids.

To your freedom!

– David

P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with My Team:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then schedule a call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to attend one of our upcoming member events as a guest. www.freedomfounders.com/schedule

2. Become a Full-Cycle Investor:

There are many self-proclaimed genius investors today who think everything they touch turns to gold. But they’re about to learn the hard way what others have gained through “expensive” experience. I’m offering a free report on how to become a full-cycle investor, who knows how to preserve and grow capital in Up and Down markets. Will you be prepared when the inevitable recession hits? Get your free report here.

3. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Click here to take the 3 minute assessment and get your scorecard.