by Dr David Phelps

“For real estate investing, it's not about timing the markets. It's about understanding the waves, the rise and fall of the market.

It's understanding why they happen and how to look at these changes from a logical, not an emotional standpoint.”

Note: This is the second part of a two-part blog video. If you haven’t read part one regarding investing in tangible assets, you can check it out here. This week we’ll be discussing how understanding the patterns of market cycles will help your business and investments thrive during a recession.

Where are we in the Market Cycle?

There are different cycles we need to keep in mind. There are the general market cycles that most are familiar with that typically last six to eight years (the last cycle was prolonged by the fed’s decreasing of interest rates and stimulation of the economy – trying to keep the “party” going at all costs).

There’s also a bigger, what I call, secular cycle. This last one started in 1980 and lasted until about 2020 (a 40-year cycle).

This means we are in the middle of a market cycle AND a secular cycle shift. In economic circles, this is termed “rolling over”. We're rolling over or moving away from cheap money, over-inflated assets, and a stimulative marketplace.

The Federal Reserve kept interest rates low and injected additional liquidity into the economy starting back in the 2008 Great Financial Recession and then quadrupled that during the COVID pandemic. But no amount of printing of money by the government will be able to stop what’s coming.

The First Way to Lose Money – Recency Bias

If you owned or invested in any kind of tangible asset or financial product in the last decade, your asset or product value went up. This was a growth period and it was relatively easy to profit during this part of the cycle.

The issue lies in thinking that this increase in value is the way it always works. You have to be aware of recency bias – the fallacy that patterns will continue on as always. (I did an entire blog post on this a few weeks ago. You can read about it here.)

You can not look back to the past, to history – looking at only one pattern, one time period, one perspective – with any predictive certainty of what it may look like in the future. History can inform and give you lessons to take into the future but it takes analysis of several patterns, and in this case, cycles before we can glean what we know to be always true – things will always change.

But I see too many people using this past decade of growth as a promise and a guarantee of future growth. These people have been very productive and profitable in the real estate investing marketplace in the last decade or even in the last two to three years for that matter.

And they go on to say, “Hey, don't worry about the higher interest rates. Don't worry about the sluggish economy. All you have to do is invest, whether you're investing in funds or syndications, or single-family rental properties. Don't worry about it. Just invest because long-term real estate always goes up.”

This is not true.

Don’t Time the Markets. Understand the Rise and Fall of Markets

In the 2008 Great Financial Recession, interest rates were going down when the Fed was trying to “ride the markets”. At the same time, real estate was also going down. Asset values decreased causing a real estate market crash. Real estate asset values do, in fact, decrease sometimes.

But interest rates and real estate are not always a congruent cause and effect. There are always lag periods and that is what I want you to understand. It's not about timing the markets. It's understanding the waves, the rise and fall of the market. It's understanding why they happen and how to look at these changes from a logical, not an emotional standpoint.

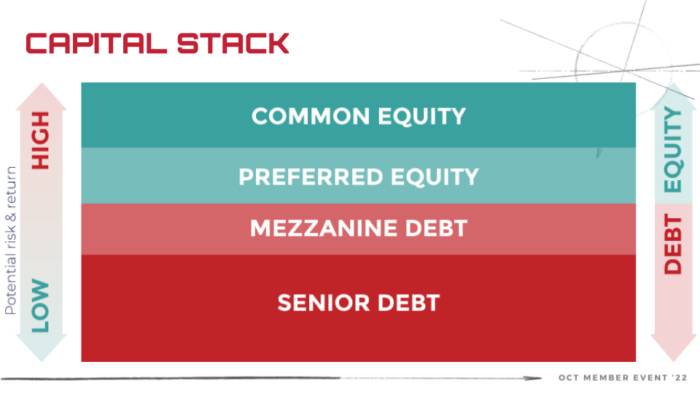

What you need to know is that there are different ways to invest in real estate. There’s investing on the equity side and the debt side.

Most people invest in the equity side of the capital stack. That means ownership. Traditionally, that is where money is made, whether it is in business or in other tangible assets like real estate. These all have some ownership or share of ownership in the equity portion of the capital stack. This is also where the tax benefits and the ability to leverage comes from. It's also where the inflation hedge or appreciation or value add comes from.

Equity is what most people think of when investing in tangible assets. It’s not a bad investment. Definitely not. But during major shifts in market and secular cycles, you need to be more cautious.

Cautious, not stalled. Don’t do nothing. It’s certainly not a time to put your head in the sand. It is a time to reposition where you are on the capital stack. The other side of the capital stack would be the debt side.

Not debt as a liability like borrowing money to buy a home, car, or business (this includes a dental practice). Debt as an asset. Lending your money just like a bank.

Lending is a very safe place to be when going through a market cycle shift and you're not sure when exactly it will occur or what it will influence.

Will There Be a Soft Landing After All?

The fed often speaks about the soft landing we're going to have coming out of this recession. I’ve heard some say it will be a hard landing. Others, that it will be a complete bust.

My perspective? It is going to be at least something in between a soft and hard landing. Consider the prolonged up/growth cycle we've had and the artificial pumping up of the economy by the Federal Reserve and Congress, both from a monetary and fiscal standpoint.

This juicing of the economy stole from the future. It borrowed growth from the future and we have to pay that back eventually. Even the United States of America, with the dollar as the reserve currency of the world, will have to pay the piper.

So how long can they kick the can down the road? No one knows for sure but I’m hedging now to prepare before it hits.

What Can You Do Now to Protect Your Wealth?

Sometimes moving from the equity side of the capital stack to the debt side can be a smart move. For instance, short-term treasury bills today whether it's four weeks, ninety days or six months are paying 5% plus.

We haven't seen this high a return on treasury bills in over 15 years. That is owning debt. When you own treasuries, you own debt. This is also backed by the US government. A pretty darn safe way to lend money while getting paid over 5% to have what we consider a risk-off or a relatively almost zero percent chance of risk at all.

Why would you take a greater risk right now?

Equities might pay eight or nine or ten percent, but the risk is they might not pay at all or might pay much less because of where we are in the market cycle.

I'm not saying to stay away from equities. It depends on where you are in life. If you have a lot of runway where you anticipate you'll be “working”, trading your time for dollars, being productive in your business for some number of years, you can afford a little bit more risk.

If you're more at the end of your career, the very high active income-producing portion of your life, you probably don't want to take as much risk. You might want to be more shy on the equity side for now.

On the other side of a market correction, also known as a downturn, that's when buying back into equities can be a great opportunity for growth and gaining wealth.

That’s what I was able to do coming out of the 2008 Great Financial Recession along with my private capital lender cohorts. I don't use banks, but I still use leverage (both debt and equity) through private capital lenders.

We would buy with all cash because the banks weren’t lending. When you have access to cash, either your own or other people’s money, and know how to put together joint ventures, then you can ride the rise of the market again.

When is the Best Time to Buy During a Downturn?

There is no perfect timing here. No matter when you make acquisitions during a down cycle, if it meets the right criteria (that criteria might change through a downturn), it can make a lot of sense.

The key is having experience of an entire full cycle (both rise and fall) to understand where you are in the cycle and if it is the right time to pull the trigger. Otherwise, you can take a different approach and go to higher ground on the capital stack (debt lending) just to be safe.

What you choose to do will differ based on:

- Where you are in your life.

- What your goals are.

- How much active income you need to replace with immediate cash flow.

- How much capital do you have in qualified retirement accounts that are locked up until you're 59 and a half.

There are many other considerations as well but the point is there is no one right answer for everybody.

Becoming Your Own Financial Advocate

I'm not giving you personal, specific advice here because I don't know your personal situation. Until you understand the variables at play in the economy and in your life, you are just rolling the dice.

If you have no game plan, you're rolling the dice. That’s why becoming your own financial advocate is vital – Educating yourself, and taking input from experts in order to make your own decisions regarding your financial future.

I've seen too many plans gone wrong. Plans made by well-meaning financial advisors and financial planners who are still playing the accumulation game with their clients because that is all they know how to do.

The accumulation game is what is promoted and given to you on Wall Street. It is where you put your money in stocks or bonds. Where they recommend the 60-40 portfolio. It has been the standard for many years. It's a model that is outdated and no longer makes any sense in this economy.

So why do they continue using the accumulation model if it doesn’t work?

Because it’s safe… for them.

As long as financial advisors follow the “Rules of Wall Street” then even when the market tanks and you lose capital (this happens through every downturn and major shift in the market cycle) they are protected.

They don't get in trouble. And, they still get paid. This is just part of the accumulation game. If you don't want to go through that, you will have to put in some work to find a different way. Especially in the face of a major market correction we’re just beginning to confront.

How to Obtain the Full-Cycle Experience to Weather All Storms

There are no freebies. There is no bright and shiny object that will be the end all. There is no magic bullet that will save us all. Even blindly throwing money into real estate investments is not the answer.

There are only two ways that will leave you with the knowledge and acumen to be prepared for every downturn, to create wealth and keep it.

The first one is to do the work as I did for 20-plus years. I created my own network and honed my skills and abilities to acquire and create Plan B assets in real estate.

If you are younger, that's a great way to get started. If you are older and you certainly don't want to waste time, then that leaves the second option.

You need to collapse time. Fold time by gaining access to a group or network that will help you learn faster and find ways to protect your investments and build wealth.

That's what we do in Freedom Founders, but you may not be ready for it. It may not be something that's right for you. And that's okay.

I still want to share this message because there's no time like today to start figuring out your game plan for tomorrow.

This Economy Will Fall. Will You Fall With It?

Today’s economy, held up by stilts, is ready to collapse with the first wave of the tide rushing in. This approaching storm will blow it over, but it’s up to you to decide whether you are knocked over with it.

Where are you financially? Do you have any safety measures or hedge positions to protect your wealth?

It's a travesty to see people who have worked hard all their life, have accomplished society’s definition of success, and have put money away wherever they were told to put it…Only to see, as they approach the end of what should have been a good long career, 50% of their nest egg washed away by the economic downturns.

They are left confused at what happened while their financial advisor says to “ride it out” because they can only recommend what they know. If your capital is all tied to the financial markets, you will get beat up with it.

Is Getting Educated Worth it?

That's not to say that the tangible asset marketplace (businesses or real estate) is not susceptible to the cycles. They are, but you have so much more control and proximity to those investments.

Proximity means you're either managing that business/real estate or are working closely with someone who manages it for you. That’s how I did it for many years. I had other managers helping me manage what I had and I was close enough to them to remain in-the-know and able to influence them if necessary to get the results I wanted.

This amount of control allows you to adapt and pivot when the market changes so you can shift your strategies and models to remain profitable and protected no matter where the economy moves.

Does that take time? Does that take energy?

Absolutely. Was it worth it?

It was for me. I was able to escape the chair about 20 years ago and have enjoyed the second half of my life tremendously. The main benefit was having the time to focus on my daughter – who was sick so much of her early life – without feeling guilty because I wasn’t providing enough active income through running my dental practice.

At the time, I was torn. I had the responsibility of a dental practice where patients and staff were depending upon me for guidance, to provide for them. That's what you do when you own a business and you're the primary producer. You have to be present. And there is nothing inherently wrong with that.

The issue lies when you want to buy back some time freedom and you don’t want to feel guilty for doing so. How can you take time off, even if you're not ready to “retire” or be done practicing? Can you give yourself permission to take some time off along the way?

Instead of feeling like you have to grind it out all the time, pursuing some pie-in-the-sky accumulation number (usually millions of dollars) that makes no sense, you can begin to give yourself freedom to do more with your time while making your money work for you.

Most buy into this mentality of constantly pursuing and pushing off living life until the end of their career but that's the fallacy of the traditional financial model.

I hope this provided some light on this issue of creating wealth in order to give yourself more time. This can provide the first step to creating a plan that will grant you your freedom.

No Room For Error – Final Warning

Now is the time to get educated and make a change. It does not matter where you are in your life. You may be younger with more time or not. Either way, economic headwinds are heading for us all. And there won’t be as much leeway like we’ve had in the past forty years with the lowering cost of capital.

If you are mid-career, you may be nearing a large inflection point that can determine the state of your financial future. This means you need to guard against taking any large hit to your capital right now.

If you are towards the end of your career and want to sell the business or practice, you need to learn where to put your capital before selling. If you are no longer working your equity in your business, you will be completely at the whims and mercy of the market.

If you have never studied how the market behaves and shifts before, you may be in store for a lot of frustration, maybe even desperation. Don't let that be you.

To your freedom!

– David

P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with My Team:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then schedule a call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to attend one of our upcoming member events as a guest. www.freedomfounders.com/schedule

2. Become a Full-Cycle Investor:

There are many self-proclaimed genius investors today who think everything they touch turns to gold. But they’re about to learn the hard way what others have gained through “expensive” experience. I’m offering a free report on how to become a full-cycle investor, who knows how to preserve and grow capital in Up and Down markets. Will you be prepared when the inevitable recession hits? Get your free report here.

3. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Click here to take the 3 minute assessment and get your scorecard.