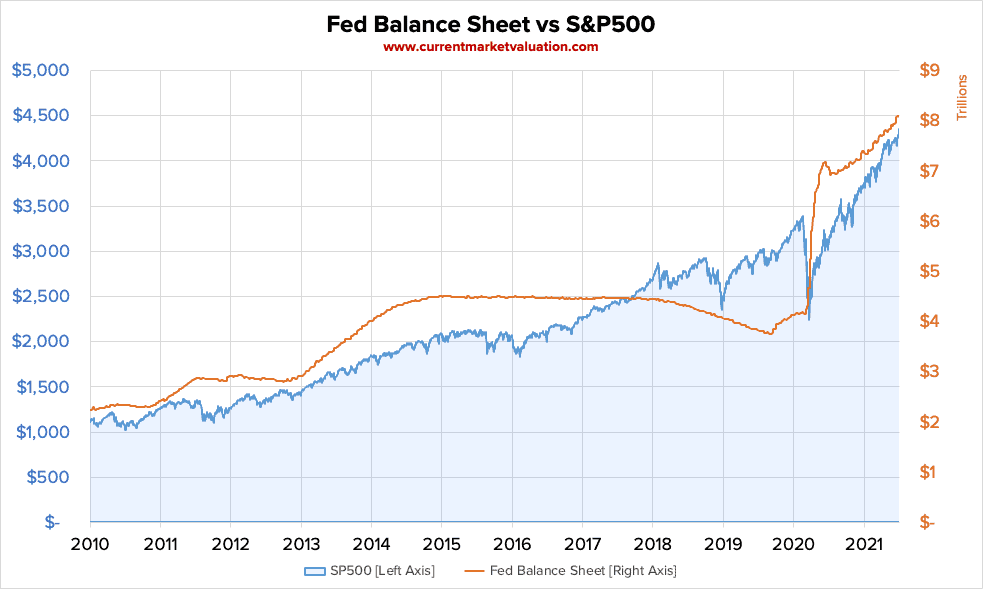

An Eerie Correlation...

The latest stock market gains (since climbing out of March 2020) have an eerie correlation with the Fed's balance sheet.

What does that mean for you and me?

It means the gains we’ve seen on Wall Street are NOT due to real growth or increased valuations. They are being propped up by the Fed’s printing press. I’m not here to debate whether or not the Fed should have done what it did back in March of last year (the markets had plummeted 30% and there was near-panic across all sectors of the economy). The point is, they decided to do it and sort out the consequences later. But “later” is coming due. Make no mistake - there WILL be consequences.

How Long Can the Fed Keep Their Foot on the Gas?

The Fed is continuing to purchase $120 BILLION PER MONTH of financial assets (by printing money). Given the fact that this stimulus is continuing to prop up the economy, there is little political will to slow down. But the Fed can’t keep doing this forever (without lasting damage to our Fiat financial system). At some point, they will have to take their foot off of the gas pedal.

Chairman Powell finally admitted this week that his position on inflation being “transitory” may not be correct. (You can find his exact words if you Google it.)

Admittedly, Powell is between a rock and hard place: Keep playing chicken with inflation by pumping billions into the economy every month, or take his foot off the gas and face a market that may behave like an addict coming off of a high. (In this case, the biggest high of a lifetime).

Either way, it appears we’re due for a reminder that bull markets don’t last forever. Mark my words, we’re in for a bumpy ride. I can’t say “when” exactly. I don’t have a crystal ball. But the market math simply doesn’t add up any more.

To be clear: I’m NOT a pessimistic investor. Like one of my longtime (virtual) mentors John Mauldin, I consider myself to be a cautious optimist. Over the last 40+ years, I’ve been through:

Here is what I've learned...

1 - Take Control Of Your Own Wealth.

Wall Street is becoming increasingly manipulated by a few large players whose choices and actions can affect the life savings, dreams and futures of millions of Americans. Yes, you can pick stocks and adjust your portfolios… but at the end of the day, it’s all at the mercy of the markets.

It doesn’t matter which game you choose - it’s all controlled by the house. Can you win big? Yes, sometimes. But at the end of the day, the house ALWAYS wins.

2 - Invest In Real, Tangible Assets.

Wall Street paper has no intrinsic value. A 3-2 house with a sturdy roof does. I’ve always been biased toward real, tangible assets such as real estate. In my experience through multiple corrections over the last 40+ years, they create cash flow whether markets are going up, down or sideways.

There are still opportunities in single family, multi family, and commercial projects… IF you are connected to the right sources who can provide quality deal flow.

3 - Always Have a "Plan B"

Don’t gamble on markets going up forever. While you can’t perfectly time the market cycles, you can ride the waves. I personally DOUBLED my net worth coming out of the 2008 financial crisis. When markets reset, there is always opportunity for those who are well connected and have access.

Bottom line: Be CAREFUL about following the majority. There is a lot of hot money chasing yield right now, wanting to squeeze every last drop out of a bull market run that is getting very long in the tooth. There has rarely in my lifetime been a more dangerous time to be an investor.

How long do YOU keep throwing the dice on your future? Now is the time to be creating a “Plan B”, diversifying assets outside of Wall Street and investing in developing your network so that when the next correction comes, you’ll be ready.

David

PS: If this resonates with you, click here to set up a call with my team to discuss your situation and see if Freedom Founders is the right fit for you. We're not for everyone, but in the right hands, our anti-traditional model can make all the difference.

2 thoughts on “How the Fed is Propping up Wall Street”

I am all for diversification out of Wall Street but never can be sure of what to expect from my rentals each month! Something is always breaking and cutting into my income!

Thanks for sharing your feedback! Yes, success in real estate often comes down to the management. Many investors find themselves trapped into becoming “accidental landlords” – dealing with tenants, toilets and contractors. While that may be a great model for some, for busy professionals, this is often not a fit. At Freedom Founders, we focus on being truly passive investors through strategic collaboration. There are tremendous opportunities in real estate to create sustainable, predictable cash flow through collaboration with operators who first and foremost align with your core values (integrity, character, etc) and who have expertise in specific real estate niches, providing quality management… no surprises.