Work hard. Save money. Retire. That's the American dream, right?

You take your hard-earned money, invest it over time, and watch it grow.

But like so many things, it's easier said than done. Or is it?

Look in your pocket. Do you have a dollar? Let's say you have just $1.

You can take that dollar, and over the course of the next year, double it. Now you have $2.

Pretty simple and you already knew that, except here's where things get interesting.

Say you take that $2 and double it to $4 the next year, then double that to $8 the next, then $16, then $32, and so on.

If you continue that for 20 years, your $1 will have grown into just over $1,000,000.

That's right. One million dollars.

The growth explosion is ignited through the power of compound investing.

In other words, not only do you reap a return on your original $1 investment, but you also get returns on the interest that dollar earns.

It's the dream of every investor approaching retirement today.

But if it's that simple, why isn't everyone cashing in on it?

We’ll call it: The Tax Effect.

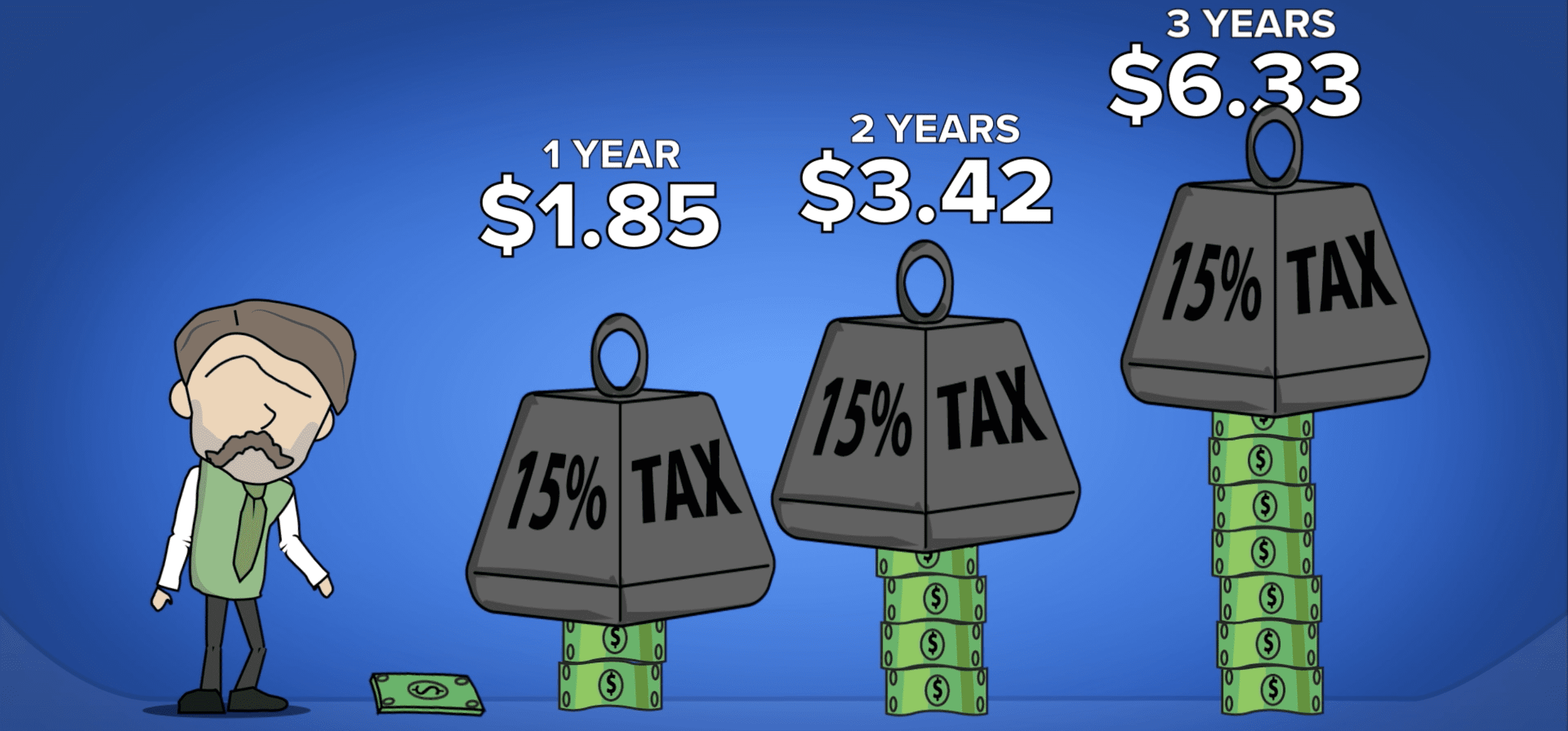

At a 15% tax rate, that's removing 15% of the earnings each year before doubling again.

That same dollar now becomes $1.85 cents after a year, then $3.42 after 2, $6.33 after 3, and so on.

Fast forward 20 years and your original dollar has now turned into… $250,000.

Three quarters of your investment growth simply disappears. And that's just the beginning.

At a 28% tax rate, that one dollar grows to a mere $51,000.

At 39%, the top marginal tax rate in the U.S, that same dollar doubled over 20 years will only grow to a dismal $13,000.

One million dollars down to $13,000.

Ouch. That's the effect that taxes can have on your ability to grow wealth.

So… about that American dream.

Now before you go spend that dollar on a tiny cup of coffee instead, listen up.

The tax code, crazy as it is sometimes, does include special incentives for investors and business owners willing to take on the risks of investing.

These incentives or legal preferences include opportunities like self-directed IRAs, Roth IRAs, and purposeful real estate investing.

Learning how to use these options is the key to compounding your net worth.

And the best news is, it’s not too late to start.

How you manage your tax liability today may very well define your financial legacy.