by Dr David Phelps

“Employment stability is strong right now, but it's the price instability that is wreaking a lot of havoc in the marketplace. The Federal Reserve played the only card they had by raising short-term interest rates.

The only rate that the Federal Reserve is able to control. They do not have control over long-term interest rates.”

Mortgage interest rates will remain high and will likely increase. Currently, the long-term 30-year fixed-rate mortgage is averaging around 7%. I believe mortgages will stay in this range, potentially rising to 8% in the coming months.

The Rise of Mortgage Interest Rates in 2023

The recent events in the last several years show us why interest rates will continue to be high. Going back to 2020, the start of the COVID-19 pandemic, the mandatory shutdowns, and the stimulation of the monetary system due to said shutdowns.

The Federal Reserve pumped trillions of dollars into the economy and caused, for the first time in 40 years, a substantial increase in inflation.

The genie was out of the bottle for the first time in 40 years and inflation is never a good thing for the general populace. People began to lose the ability to make ends meet. This prompted the Federal Reserve Chairman, Jerome Powell, to try to bring inflation back down. To try to stabilize prices and employment. (I wrote extensively about the history of inflation and its current effects on our economy in my recent book.)

Employment stability is strong right now, but it's the price instability that is wreaking a lot of havoc in the marketplace. The Federal Reserve played the only card they had by raising short-term interest rates. The only rate that the Federal Reserve is able to control. They do not have control over long-term interest rates.

They increased rates by over 500 basis points, essentially 500 percent in the last 15 months. That is a massive relative change. An unprecedented rate of change in history.

The five percentage point increase is not the concern. It is how fast it went up. The overall 5x times rate over a short period of time is causing instability and volatility in the marketplace.

This instability in the marketplace causes long-term investors and institutional investors to be uncertain about where to get their best yield or return on capital.

Pension plans, public and private, across the country have to try to find a yield to pay the people who depend on these pensions. So where do they go?

Typically, they go into equity markets. Well, those are very volatile right now and are starting to show how difficult it is to achieve such results (I discuss an example of this – Tides Equity Group – in another blog of mine. You can read it here).

With the Federal Reserve interest rates going up, one can now achieve a relatively good rate of return, essentially risk-free in short-term Treasury bills. Short-term Treasury bills (One year or less) are currently paying over 5% interest rates.

We haven't seen that since before the Great Financial Crisis in 2007. Interest rates, before 2022, were the lowest they have ever been for the last 14 years. This stability of low-interest rates is what has caused many issues in terms of expectations.

People thought it would last forever and that the same methods of obtaining a high return would continue to function as permanent. But the Federal Reserve has to fight inflation. And that comes with volatility which requires different ways of sustainably obtaining a return on your capital.

The Demand for Higher Yield Increases Interest Rates

Commercial-backed mortgage interest rates and housing interest rates are packaged together and purchased by institutions such as Fannie Mae and Freddie Mac and sold to long-term institutional investors.

These investors demand a higher interest rate or a higher yield spread than what they could get in short-term US Treasury rates. Currently, short-term Treasury bills are paying over 5% with no risk at all.

So if I'm going to invest in longer-term bonds or notes, 15-30 years, then I'm going to demand a higher return premium. That is why long-term mortgage interest rates are higher today and climbing.

Institutions and hedge fund buyers require a higher return. Otherwise, it would make more sense to put their money in short-term notes, paying 5 ½% with much less risk. This means you need a promise of at least a 7 ½% return to make up for the risk of a longer-term note.

Inflation or Higher Interest Rates? Most Likely, Both.

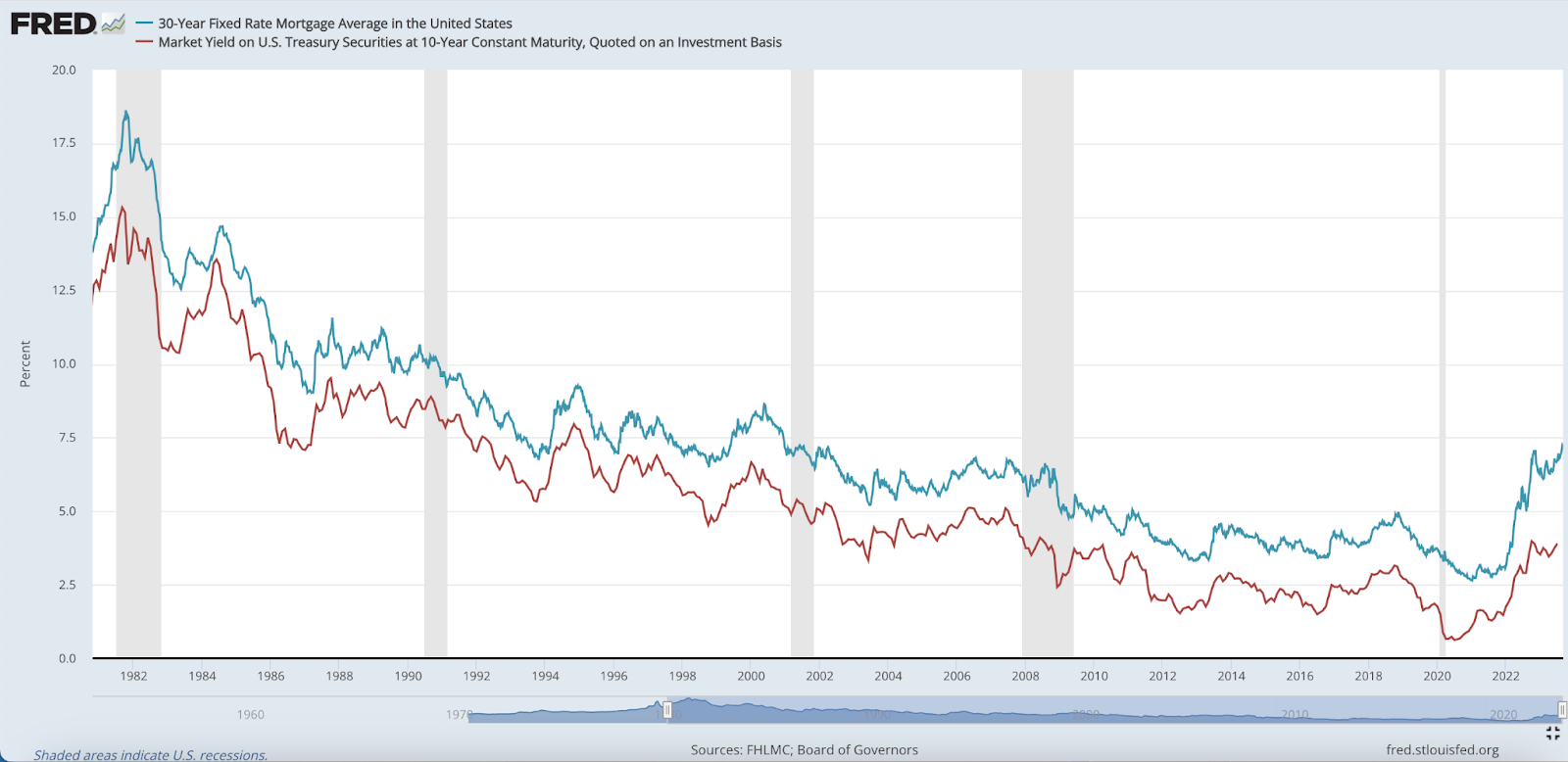

History shows that the 10-year treasury notes correlate very closely to what 30-year fixed-rate mortgages will be.

If you go back 40 years and look at the graph comparing the two they run in correlation (see below). The basis for this is that mortgage interest rates need to be higher than the 10-year treasury because treasuries are always considered risk-free, and backed by the U.S. government.

So anything outside of treasuries has to be priced at a premium. If you observe the 10-year treasury, which has gone up substantially in the last 15 months from very low to now over 4%. This means the 30-year mortgage-backed security has to be priced higher.

I would not trust the ability of the Federal Reserve to control inflation at this point. And that uncertainty, and lack of trust, will keep pressure on the 30-year fixed-rate mortgages to stay high for some time.

We might see small swings where it goes down for a short period of time but the general trend is for 30-year fixed-rate mortgages to stay high and even increase.

We will see a point where the Federal Reserve feels like they are tamping down inflation. But the more they do, the more a recession and higher unemployment will be present. This will, of course, cause more problems in the economy.

This will prompt the Federal Reserve, from a political standpoint, to want to swing back the other way. They will want to pump the economy back up again. This will lead to more inflation, yet again.

I believe that this back-and-forth seesaw will happen for quite some time. The significance of this is that long-term investors will NOT take the risk of going out longer term without undue increase in return. An increase in risk means higher rates.

Why would they settle for lower rates? It is too risky, which is why interest rates will increase to offset that risk. They have to stay high.

A Recession is Here

This is an era of rising interest rates. They will not come down again to where they were prior to 2020, at least not for a long period of time. Investors and people in general, will need to adapt to this new economic environment.

This means equity markets will have to be re-priced. Real estate, for example, has to be re-priced according to the higher interest rates. Higher interest rates mean people who are borrowing to buy real estate can no longer afford to buy real estate, especially with the higher prices that we have seen pushed up in the last three years.

Asset values will come down. Eventually, we will hit some equilibrium and that is where our correction will come into play.

To your freedom!

– David

P.S. Next Week, I am personally leading a small-group, online 4-week course that will give you the basic frameworks and concepts to build wealth throughout any market cycle, as well as how to become an advocate for your own capital investments to reach your personal and professional long-term goals.

I can give you guidance based on my 40+ years of real estate investing and over a decade of helping other health professionals reach financial freedom in 5 years or less. This is a course guaranteed to save you a lot of time, misery, and wrong turns. Register now for the 30-Day Blueprint Course by clicking here!

P.P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with My Team:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then schedule a call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to attend one of our upcoming member events as a guest. www.freedomfounders.com/schedule

2. Become a Full-Cycle Investor:

There are many self-proclaimed genius investors today who think everything they touch turns to gold. But they’re about to learn the hard way what others have gained through “expensive” experience. I’m offering a free report on how to become a full-cycle investor, who knows how to preserve and grow capital in Up and Down markets. Will you be prepared when the inevitable recession hits? Get your free report here.

3. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Click here to take the 3 minute assessment and get your scorecard.