by Dr David Phelps

Book David Now

Want to know more about David and schedule him as a speaker or podcast guest? Go to doctorphelps.com to book David now.

A

mericans awoke this morning to even more uncertainty.

Votes are still being counted. Both candidates are deploying armies of lawyers to fight tooth and nail over each county, precinct, and ballot.

What a mess.

There is a lot at stake. These two candidates have radically different visions for America – no question. But the unspoken reality that none of the political pundits are discussing right now is that, regardless of which candidate wins, there are larger demographic and socio-economic trends at play that are unlikely to be reversed. These larger trends will likely have an even greater impact on you and your family than the outcome of this election.

If you’ve been following me for any length of time, you’re familiar with my mentor, Dan Kennedy. Dan has tremendous insight into human behavior and market trends. He recently shared this somber prediction with me regarding the election…

“It may be a five year window at best, largely dependent on what happens in November… it’s going to get exponentially harder to move income to wealth.”

– Dan Kennedy

Dan’s point: Neither candidate could fully reverse the broad trends we’re seeing across this country. The winner of this messy election may accelerate or slow the trend – but it’s scope extends beyond any presidency.

The tide is going out. No man can stop the tide.

Here is a short list of some of the threats and opportunities that I see on our horizon, REGARDLESS of the outcome of the election this week.

The Coming Storm: Underlying economic indicators are all pointing toward more volatility.

The last several months of federal stimulus has temporarily put the economy in a false sense of suspended animation. However, we know from history:

Crisis ALWAYS creates new legislation/regulation

Crisis destabilizes debt (the foundation of our economy

Crisis accelerates the transfer of wealth (the gap between the “haves” and the “have nots” is widening despite massive government spending on social programs)

Government response can destabilize currency valuations (deflation/inflation)

Lending is grinding to a halt right now. When lending slows or stops, credit contracts. When credit contracts, every asset that relies on it to support prices will fall in value. US banks are aggressively tightening up their lending and shoring up cash reserves:

– Wells Fargo and Chase Bank are no longer offering Home Equity Loans

– Bank of America is halting it's funding of start-up businesses

Our society and financial system is ENTIRELY predicated on the endless expansion of credit…which is of course, DEBT. We are living through the largest corporate debt build up in US history, while simultaneously running the largest Keynesian economics experiment in world history. This will have massive, long term consequences. Neither president could get the growing debt crisis under control. The truth is, America is not willing to bear the pain that would be required. We will keep kicking that can down the road… as long as we can.

Wealth redistribution is becoming mainstream – moving up the economic ladder is only going to get harder.

An entire generation of Americans have entered adulthood knowing virtually nothing about the basic principles of wealth generation and preservation. The values of our society are shifting.

During the cold war (my childhood), socialism was seen as a threat to our American values. There were witch hunts for communist sympathizers. Today, it is openly embraced by political figures, celebrities, and many who seek to curry favor with the masses.

For high income earners – the window of opportunity to translate income to wealth is shrinking.

Income will continue to be taxed at increasingly higher rates. For the practitioner and business owner, an ever-tightening web of regulatory compliance and liability are squeezing opportunities and profit. The ability for business owners to control their own destiny will become steadily more limited. It will become harder and harder to translate income into wealth. The very idea of “wealth” is increasingly vilified. Our TV screens have blazed with images of rioters and looters hurling molative cocktails into the livelihoods of law-abiding business owners, as well-meaning police officers are ordered to stand down. The world is turning upside down. And there is no end in sight.

The lesson of 2020: You need alternate streams of income.

If 2020 has taught us ONE lesson – it is that it’s extremely risky to have only one source of income. Who would have imagined that the government would mandate that businesses in almost every sector MUST completely shutter their doors for months?

Overnight, your practice became a massive liability – offering zero cash flow, and requiring that you be responsible for significant overhead costs. It is a frightening precedent for the future.

The 2020 shutdown should be a wakeup call for every practitioner: Your “active” income is more vulnerable than you think.

Next time it may not be a pandemic… But it may be a natural disaster, or national security threat, or (heaven forbid) the rioters coming to your street. Maybe it will be a personal health crisis (such as my daughter’s battle with leukemia which forced me to step away from my practice for years). Or maybe your local city council will decide to tear up the road in front of your office… barricading you in with orange traffic cones and an asphalt surfacing machine.

Or maybe your back simply can’t take another year bending over the chair.

The point is – if you don’t have alternate cash flow from outside your practice, you are extremely vulnerable to the next disruption. Don’t miss the single greatest economic lesson of 2020. You’ve been given the gift of a second chance. Now is the time to build a “Plan B” for predictable passive cash flow so that next time – you’ll be ready.

Can your retirement really withstand another 30% nosedive?

The recent resurrection of the stock market can be closely correlated with the massive influx of government stimulus. Completely novice investors with barely any stubble on their chin are downloading apps like “Robin Hood” (aptly named) and playing the stock market like a video game with government stimulus checks.

The stock market is rapidly becoming a casino in which serious high-net worth investors have very little control. It is not a path to creating sustainable, generational wealth.

Most investors have short memories. Many are already forgetting the lows we experienced just a few short months ago. Don’t get lulled into a false sense of hope. Do you really want your retirement held hostage to another 30% nosedive with little to no warning?

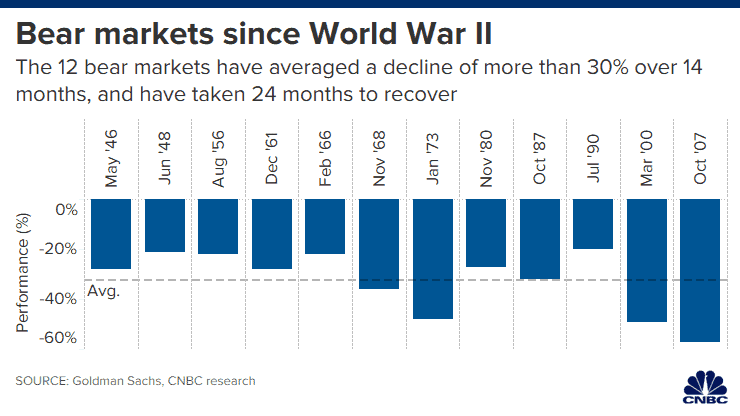

Historically, true Bear markets take years to recover from, on average. Consider the chart below…

The massive government stimulus has helped markets rebound in the short term, but at what cost? History suggests that next time, we might not be so lucky.

This recent rebound is a key opportunity to harvest equity from a market high and deploy it into secure, tangible assets that create sustainable, predictable cash flow regardless of market volatility.

5. There is a wealth transfer happening right now. Which side are you on?

In a recession, wealth isn’t lost – it changes hands. I call it “The Great Wealth Transfer.” The majority of the population will lose wealth… but others, who take proactive and decisive action, can actually make up for lost time.

In times of market transition, there is a tendency NOT to take action out of fear of the unknown and uncertainty. But as my friend and Chief Financial Officer Burt Copeland says… “If you're unwilling to pivot, you better be sure you're right.”

Are you confident in the current path you’re taking – whether by plan or by default?

NOW is the time to be preparing for the uncertainty of the future. Now is the time to be creating and securing wealth.

This is what Freedom Founders is all about: helping “successful” practitioners and business owners to secure wealth by investing in tangible assets that generate predictable, reliable cash flow that is indexed to inflation and that minimizes tax exposure.

Do you have a plan that you are confident will guide you to safety and Freedom in the uncertain years ahead? Will you position yourself to thrive in the future... or will you be left behind?

To your freedom!-David Tweet

P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with Me:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then click the link to jump on a quick call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to schedule a call with me directly. www.freedomfounders.com/schedule

2. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Go to www.FreedomFounders.com/Scorecard to take the 3 minute assessment and get your scorecard.

3. Ready to Step Away?

“How Much is Enough?” This simple question keeps hard-working professionals at the hamster wheel of active income far longer than they need to be. Watch this free training, and discover a proven model for determining how much you really need before hanging up the handpiece! www.freedomfounders.com/training

4. Apply To Visit The Mastermind:

If you’d like to join dozens of dentists, docs, and practice professionals on the fast track to Freedom (3-5 years or less), visit www.freedomfounders.com/step-1 to apply for a guest seat.